By Daniël Wolswijk und Bernhard Uitz

While financial institutions are currently working intensively on scoping for the shortening of the securities settlement cycle to one business day (T+1), the next phase is already coming into view: operational implementation. This article highlights the issues that need to be addressed now to ensure that T+1 does not become a last-minute challenge.

Following the analysis phase in scoping (part 1) and the assessment of key dependencies (part 2), we now turn our attention to practical implementation. And here it quickly becomes clear that T+1 is not an isolated IT project, but a profound intervention in the interaction of processes, data, systems and market infrastructures. At the same time, the final ESMA report turns many of the previous recommendations of the EU T+1 roadmap into de facto mandatory requirements – for example, in trade date matching, the use of partial settlement or the automation of corporate actions.

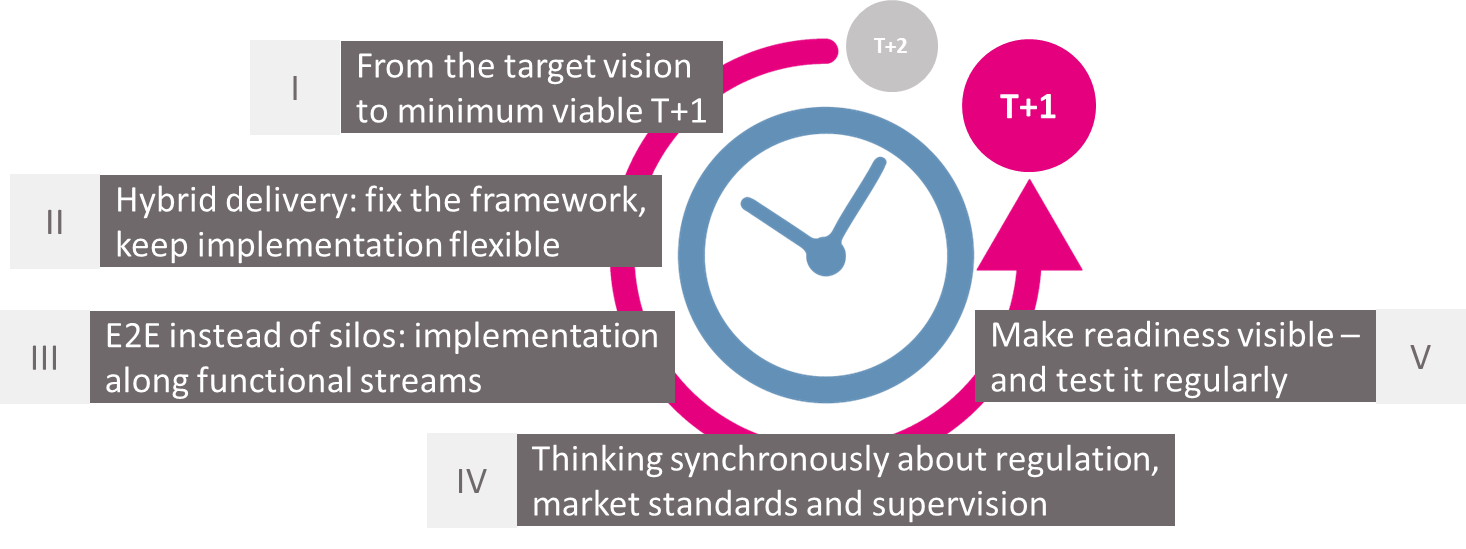

This third part focuses on how banks and securities institutions can realistically organise implementation. To this end, we define five ‘milestones’ that provide guidance:

I. From the target vision to minimum viable T+1

Anyone who wants to successfully implement T+1 must set clear priorities. Not all products, markets or internal processes can be brought up to the new standard at the same time. A minimum viable T+1 helps to manage the complexity: Which process chains must be functioning without a doubt by the deadline of 11 October 2027, and which areas can – with good reason – follow in waves?

The focus should always be on the target vision: Which steps must actually be automated and running smoothly by the gating events of the roadmap to ensure timely processing? Those who rely too heavily on existing structures run the risk of ‘building T+1 into the old world’ – and not reaping the benefits at all.

II. Hybrid delivery: fix the framework, keep implementation flexible

The requirements surrounding T+1 are still changing in some respects, whether due to ongoing ESMA consultations, national supervisory expectations or the tightening of market practices. This is why a hybrid approach is needed: the overarching architectural framework is defined in a stable manner, while the concrete implementation takes place in iterative steps.

This combination of clear principles and flexible design is necessary because many decisions regarding market infrastructure are only gradually being finalised. For example, ESMA’s latest RTS adjustments tighten expectations for intraday matching and partial settlement; this is precisely why the delivery structure must be able to accommodate changes without jeopardising key milestones.

III. End-to-end instead of silos: implementation along functional streams

T+1 seamlessly intervenes in the entire value chain, from trading to posting. Implementation along traditional organisational lines quickly leads to friction losses. A structure based on functional end-to-end streams, such as ‘Execution & Matching’, ‘Settlement & Liquidity’, ‘Corporate Actions’, ‘Master Data & SSI’ or ‘FX & Cash’, is therefore more successful.

A look at North America shows how crucial this end-to-end view is. One year after the introduction of T+1, market participants there report – among other things in a recent evaluation by SWIFT – that the biggest challenges were not in settlement itself, but in the upstream processes: matching, allocations, FX, cash forecasting, and the timeliness and quality of master data. In many cases, these ‘upstream bottlenecks’ only became apparent during live operation – with a direct impact on fail rates and operational stability. This is an important point for European institutions: it is precisely this process chain that determines performance under T+1, especially as Europe is additionally characterised by market fragmentation, multiple CSDs and different currencies.

Such streams are responsible for the entire process: process, systems, data and tests. This prevents critical transfers from being overlooked and makes it possible to identify bottlenecks at an early stage. Corporate actions are particularly relevant in this context: the ESMA report requires the fully automated processing of market claims and buyer protection, which modernises the CA chain much more than many people realise.

IV. Thinking synchronously about regulation, market standards and supervision

Implementation must not focus solely on internal processes. Three levels must be consistently synchronised:

- CSDR & ESMA-RTS, which now clearly regulate many requirements – for example, the mandatory use of partial settlement or ISO 20022 messages for corporate actions.

- EU T+1 roadmap, which defines viable market standards and timelines.

- National supervisory expectations, which are now gradually being specified.

In addition to regulatory requirements and market standards, coordinated industry coordination also plays a central role. The EU T+1 Industry Committee is currently conducting a Europe-wide market survey until 19 December 2025 to determine the maturity level of institutions. BaFin points this out in a communication to ensure the participation of German market participants. The results will be directly incorporated into the further development of the roadmap and future market practices — an important opportunity for banks to critically review their own implementation plans.

V. Make readiness visible – and test it regularly

Implementation also means proving operational capability. To this end, banks should define at an early stage how they will measure and document their T+1 readiness. This includes, for example, key figures on the matching rate on the trading day, the automated use of CSD functionalities or the quality of master data.

Equally important are regular ‘dress rehearsals’, i.e. simulated T+1 days, during which real volumes and real time windows are run through. It is precisely in interaction with trading venues, CCPs, CSDs and custodians that it becomes apparent whether the overall process is viable.

The implementation of T+1 is the moment when the course is set: if the transformation is successful, Europe will move closer to global markets in terms of efficiency, stability and competitiveness. If it is not successful, new risks will arise – in settlement, liquidity and the reputation of individual institutions. The path to this goal involves clear priorities, flexible delivery models, end-to-end responsibilities and a clean alignment with all regulatory levels.

In the next part of our series, we will focus on a topic that has a decisive impact on many of these points: Legacy IT – and thus the question of how existing core systems can support the accelerated time windows without becoming a bottleneck themselves.