The migration of Exceptions & Investigations (E&I) to ISO 20022 is changing not only the message format, but also the logic behind the processing of payment transaction complaints. SWIFT is relying on a case-based model, the implementation of which is currently presenting banks with new technical and professional challenges. We spoke to Steffen Grenzheuser, Senior Consultant and E&I expert at DPS, about the current situation and how to deal with this transition phase.

The migration of Exceptions & Investigations (E&I) to ISO 20022 is changing not only the message format, but also the logic behind the processing of payment transaction complaints. SWIFT is relying on a case-based model, the implementation of which is currently presenting banks with new technical and professional challenges. We spoke to Steffen Grenzheuser, Senior Consultant and E&I expert at DPS, about the current situation and how to deal with this transition phase.

In your opinion, what are currently the biggest pain points for banks in the area of payment transaction complaints?

Steffen Grenzheuser: In my view, the central pain point currently lies in the lack of technical clarity at the detail level. Most institutions have taken note of the SWIFT roadmap for E&I migration and know that camt.110/camt.111 and the new case management model are coming. However, what is often still unclear is the specific impact on existing E&I processes, system logic and operational procedures.

You mention use cases. What role do investigation request cases play in this?

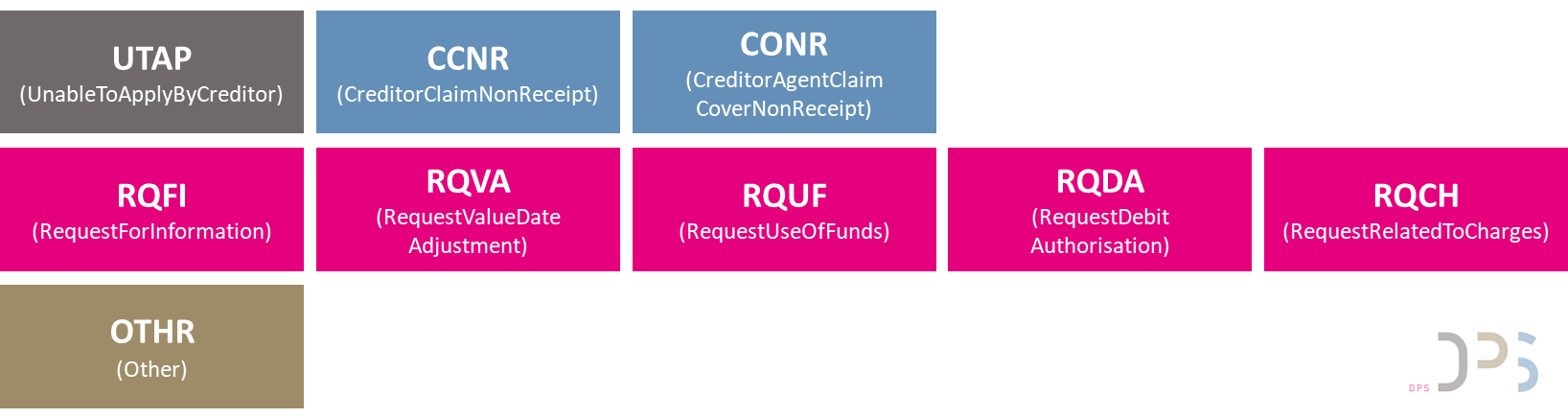

With the investigation request cases, SWIFT has taken a very important step towards bringing structure to a field that has been largely unstructured until now. A total of eight investigation types have been defined, such as UTAP, CCNR, CONR and RQFI. The problem from the banks’ point of view is not so much the idea behind it, but the fact that the case type OTHR can be used as an alternative to the defined investigation types.

Defined Investigation Request Cases (according to the CASE User Handbook SWIFT)

What are the practical consequences for banks at present?

In the current transition phase, there is a real danger that many institutions will resort to the OTHR (Other) case type for the majority of their complaints. This means that all enquiries that cannot be clearly assigned to a specifically defined investigation case will once again end up in a generic ‘Other’ channel. Although the new model would be used formally, the actual structuring and automation concept would initially only be effective to a limited extent.

Why is this problematic from a technical point of view?

The E&I target vision of ISO 20022 is to clearly classify complaints so that they can be processed efficiently, automatically and on a case-by-case basis. Today, MT-based complaint messages are often sent as free-text queries, and the receiving bank has to manually check what the issue is and what action is required. If, in future, the majority of enquiries are once again routed via OTHR, there is a risk that this pattern will initially continue – even though the architecture is actually designed for structured case types.

What role does the new SWIFT Case Management with the End-to-end Investigation Reference (EIR) play here?

Case Management is the second major paradigm shift. With the End-to-end Investigation Reference (EIR), all messages are clearly assigned to a case. It also enables smart routing: complaints are no longer passed on sequentially via several correspondent banks, but are addressed specifically to the responsible case manager. This is an enormous step forward – but it requires that the underlying investigation cases are used and interpreted correctly.

What does this mean in concrete terms for technical implementation in banks?

Technically, this means that banks must deal with case types, routing logic, EIR processing and FINplus/case management connectivity at an early stage. Passive accessibility alone is not enough here. The decisive factor is how deeply the new case information is integrated into the bank’s own systems and processes – especially in environments with historically grown E&I or payment transaction platforms.

DPS is conducting a parallel market survey on ISO 20022 E&I. What are the main questions being asked?

We are particularly interested in how specifically banks and their service providers are already addressing these issues: How clear is the planning for the E&I conversion really? And how does the current uncertainty affect their own scheduling? The results help to paint a realistic picture between regulatory perception and operational implementation.