By Frederik Toledo and Deniz Tüzel

With the publication of the Web GUI and EDS API specifications, all essential information for implementing the EPC Directory Service (EDS) is now available. This central directory service is used to identify and ensure the interoperability of payment service providers within the API-based Verification of Payee (VoP) framework – and, in the future, also for SEPA Request-to-Pay (SRTP) and SEPA Payment Account Access (SPAA). The European Payments Council (EPC) published the basis for the logical data model at the end of February 2025.

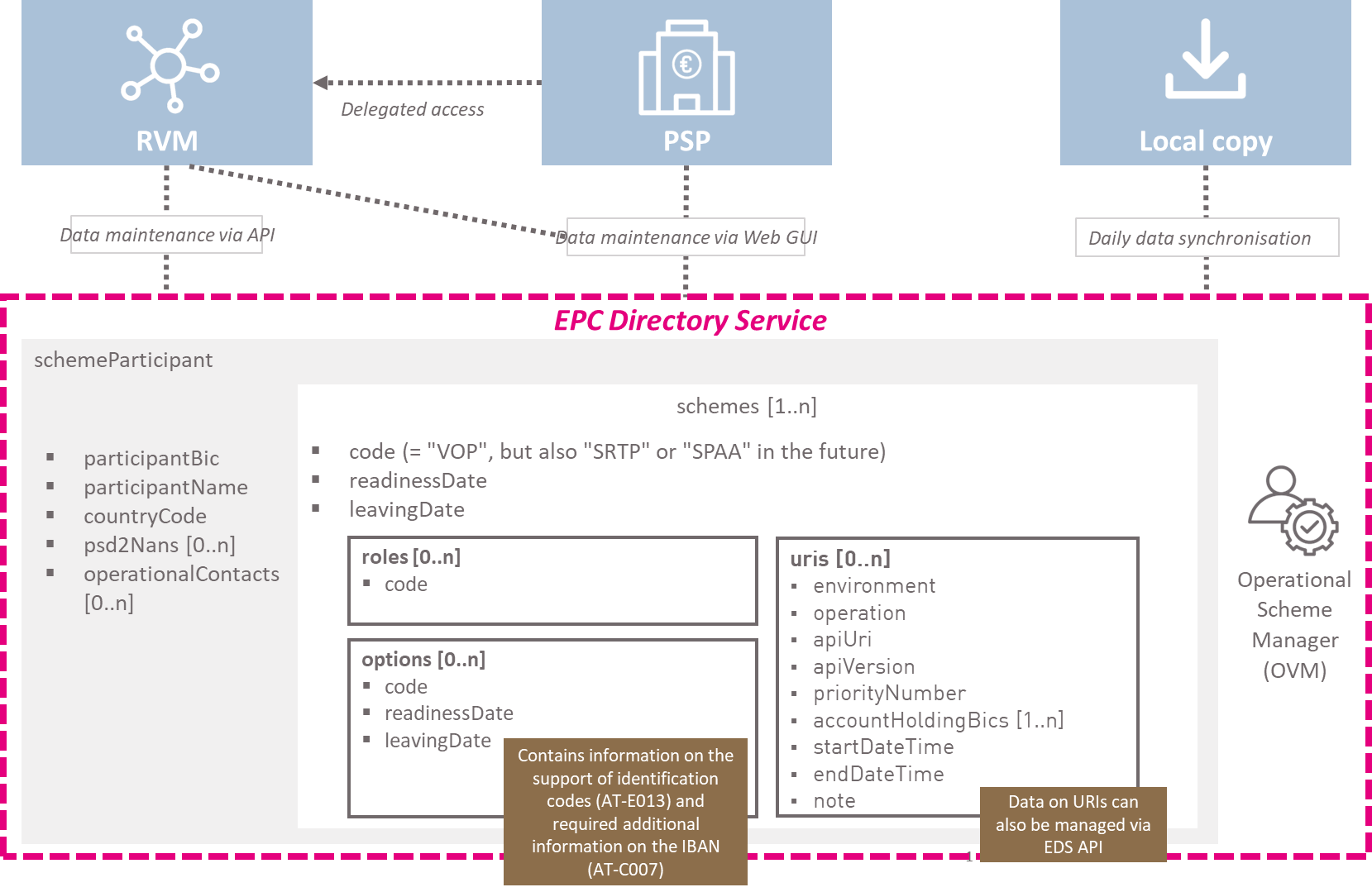

Below we provide a concise overview of the EDS:

Role and structure of the EDS in the VoP

The EPC Directory Service is like a telephone directory that collects key information about banks and other financial institutions participating in the VoP procedure. This ‘data pool’ contains all the central information needed to know who the participants are and how they can be reached.

The data contained in the EDS is crucial for interoperability between participants and must therefore be kept up to date at all times. In addition to participant identification data such as BIC and National Authorisation Number (NAN), technical information on availability is also stored. For this purpose, the URLs and their validity dates are maintained, under which a participant accepts verification requests via the EPC VoP API.

Access and use of the EDS

Access to the EDS is provided via a web GUI or API provided by SWIFT.

The EDS directory is then actually used via a local copy, which all participants download regularly. This is used to identify participants in response to a VoP request and to determine the availability (URLs) of other participants for forwarding the VoP requests.

The web GUI provides access for all participants to maintain their own EDS data and delegate administrative permissions to RVMs. The associated web GUI guidelines were published on 28 March 2025.

The EDS API published in mid-April now offers all EDS users the option of automatically downloading a local copy of the directory, providing RVMs in particular with another convenient way to maintain their data. According to the current EDS API specification, maintenance is limited to URL availability data. All other data elements can be maintained via the web GUI.

Special features for RVMs

RVM play a special role in the use of the EDS API.

Explanation: RVM (Routing and Verification Mechanism) is a technical or organisational unit (often a service provider) that performs the following tasks in the VoP process:

- Routing the VoP request to the correct payment service provider (PSP) of the recipient, based on IBAN or BIC.

- Verifying the recipient details at the target PSP (e.g. name/account combination), if necessary also using its own verification mechanisms.

- Transmitting the response to the requesting PSP, including the result (match, no match, close match, etc.).

They can not only maintain the EDS data of their connected participants via the web GUI, but also maintain the data on the availability (URLs) of the participants via API endpoints specifically designed for this purpose. The EPC has now also granted this option to PSPs that do not use an RVM.

In addition, the European Payments Council (EPC) has recently published the document ‘ART – Test Cases’. It describes specific test scenarios that payment service providers and RVMs can use to validate their VoP implementation as part of self-certification. The test cases listed cover both positive and negative scenarios – from the perspective of both the requesting and the responding party. This now provides a clear basis for technical testing to ensure the interoperable implementation of the VoP rules. DPS partner Lukas Romeiser has recently published a guide on this topic entitled ‘Quality assurance for instant payments and VoP’.

Our conclusion

With the publication of the EPC Directory Service (EDS) specifications, banks now have the final information they need to push ahead with their VoP implementation across all payment schemes. The time remaining until the mandatory start date of 5 October 2025 is short – institutions should now tackle implementation consistently in order to successfully complete time-critical integrations, tests and certifications.

DPS is happy to advise banks on this and provides support with a holistic approach that takes into account not only technical implementation but also aspects such as accessibility.