Anyone familiar with the card game UNO knows that in the end, it’s the right card at the right moment that counts. Clearstream is pursuing a similar goal with its UNO (‘Unified for New Opportunities’) project – it wants to adapt the structures in European securities settlement in such a way as to reduce complexity and increase efficiency. For banks, this means significant changes, but at the same time it opens up the opportunity to set up the upcoming T+1 projects more efficiently from the outset and reduce sources of error.

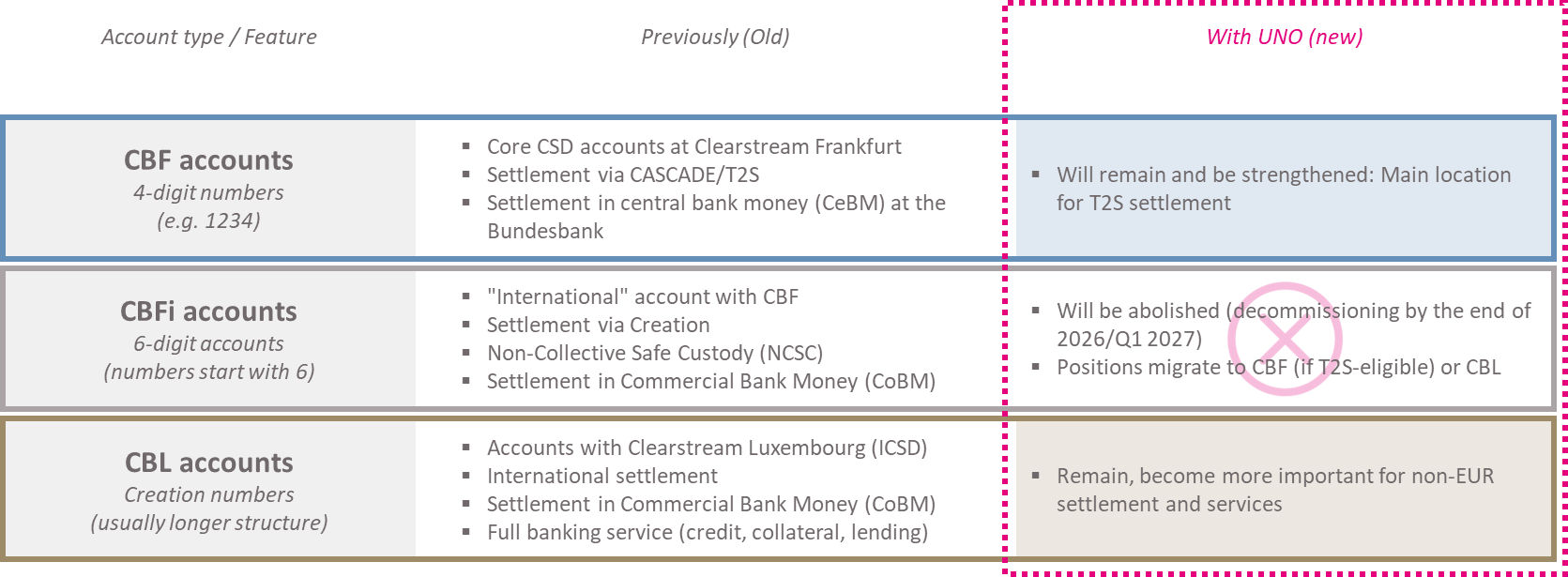

The trigger is the CSDR Refit Regulation, which allows central securities depositories to delegate bank-like services to other CSDs. Clearstream is using this opportunity to separate its roles more clearly: Clearstream Banking Frankfurt (CBF) will focus entirely on core functions such as custody, settlement and record keeping, while Clearstream Banking Luxembourg (CBL) will take over banking-related services. The CBFi ‘6 accounts’ used to date will be phased out. This will result in a clearly structured division: settlement in central bank money (CeBM) via CBF and T2S on the one hand, and banking-related services for non-euro assets via CBL on the other.

The differences between the account types are clearly illustrated in the following overview, which can also serve as a basis for the upcoming migrations:

For banks, UNO is anything but a sure-fire success. It sometimes feels like a ‘Draw 4’ card in the game: several additional tasks come up at the same time. Migration, new processes and regulatory requirements must be dealt with in parallel. The most important challenges can be summarised in seven points:

1. Migration of accounts & systems: With the shutdown of CBFi ‘6 accounts’, banks must migrate their positions and processes to CBF or CBL accounts. This requires significant IT adjustments and poses risks for settlement.

2. Adaptation to T2S: More and more securities are becoming T2S-eligible, which means banks have to get used to earlier cut-offs (16:00 CET for EUR) and standardised processes. This makes procedures tighter and less flexible.

3. Liquidity & cash management: While settlement in central bank money (CeBM) is becoming cheaper, the demand for liquidity at the Bundesbank is increasing. Non-EUR settlement will be handled via CBL in future – treasury departments will have to adjust their cash management accordingly.

4. Lending & collateral: ASL/ASL+ will only be available via CBL in future. New pledge and triparty mechanisms (ECMS) must also be introduced in collateral management.

5. Tax & asset servicing: New certifications are necessary as CBFi accounts are being discontinued. Banks must renew their documentation and adapt to harmonised but modified asset servicing processes.

6. Reporting & Connectivity: Legacy reports (e.g. for the USA/CH) will be discontinued, and OneClearstream will become the standard. Systems, interfaces and reporting must be adapted.

7. Strategic decisions: Banks must decide which assets they will hold in CBF (T2S, CeBM) or CBL (ICSD, CoBM) in future. This choice will affect capital commitment, costs and risk profile.

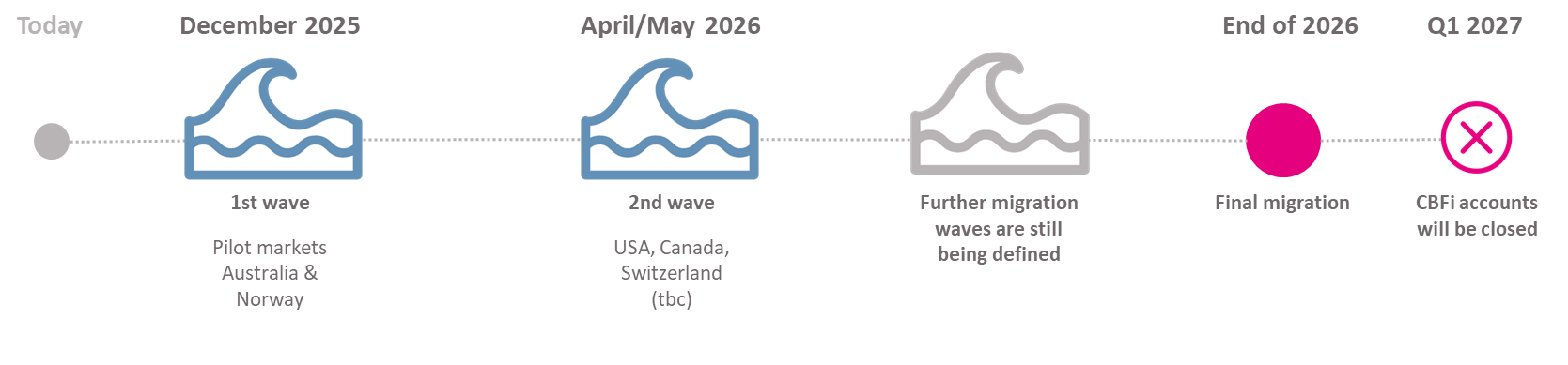

Migration waves until 2027

The transition to UNO will take place in several migration waves. Pilot migrations of individual markets (initially Australia and Norway) will begin at the end of 2025, followed by other market groups such as the USA, Canada and Switzerland in the course of 2026. With the final migration step at the end of 2026 or beginning of 2027, the existing CBFi accounts will be closed completely. For banks, this means that the necessary adjustments to accounts, systems and processes must be planned and implemented in good time. As this timetable coincides with the introduction of T+1, there is additional pressure to act – and at the same time the opportunity to closely coordinate both projects.

Planning UNO and T+1 together

This makes it clear that UNO is not an isolated infrastructure project, but rather an opportunity for banks to set up their own T+1 preparations more efficiently. The upcoming migrations will force far-reaching adjustments anyway – from system conversions to liquidity management and reporting. Those who take advantage of this opportunity can align their T+1 project with the new Clearstream architecture, leverage synergies and avoid sources of error.

My recommendation is therefore: UNO and T+1 should not be considered separately. Those who plan both projects in an integrated manner will gain a competitive edge – and, figuratively speaking, call ‘UNO’ in good time.