On 21 May 2024 SWIFT issued an announcement regarding the end of the coexistence of MT and MX payment messages planned for November 2025. This is causing uncertainty regarding the timetable for the complete transition to the ISO 20022 standard. Initial reactions from the industry referred to this as a “softening”. In the following, a brief categorisation.

International payment transactions are currently undergoing a fundamental change. Major market infrastructures are modernising their large-value payment systems and are using the ISO 20022 standard. Since mid-March 2023, following several delays, the SWIFT payment network has also been replacing its previous MT messages with ISO 20022-compliant MX messages in cross-border payment transactions (CBPR+). To facilitate the migration from MT to MX, a coexistence phase was defined with various test options and a conversion service until November 2025.

Even before the current update – and contrary to the original plans – it was known that the future requirements for structured address information in ISO 20022 would be interpreted less strictly. Accordingly, three options for address information are to be supported after November 2025: 1) a fully structured option; 2) a hybrid option, i.e. mixed use of dedicated address components; and 3) a (temporary) fully unstructured option, which should be usable until November 2026.

Selected MT message types will continue to be supported

Even if the initial text passages of the publication of 21 May do not indicate this and emphasise that the SWIFT community is determined to end the coexistence phase in November 2025, there are now further changes. Following feedback from the national committees and the Core Payments Working Group, the migration of pure payment instructions to ISO 20022 is now being prioritised. Other FIN/MT message types, such as reports and account statements, will not be discontinued immediately after November 2025.

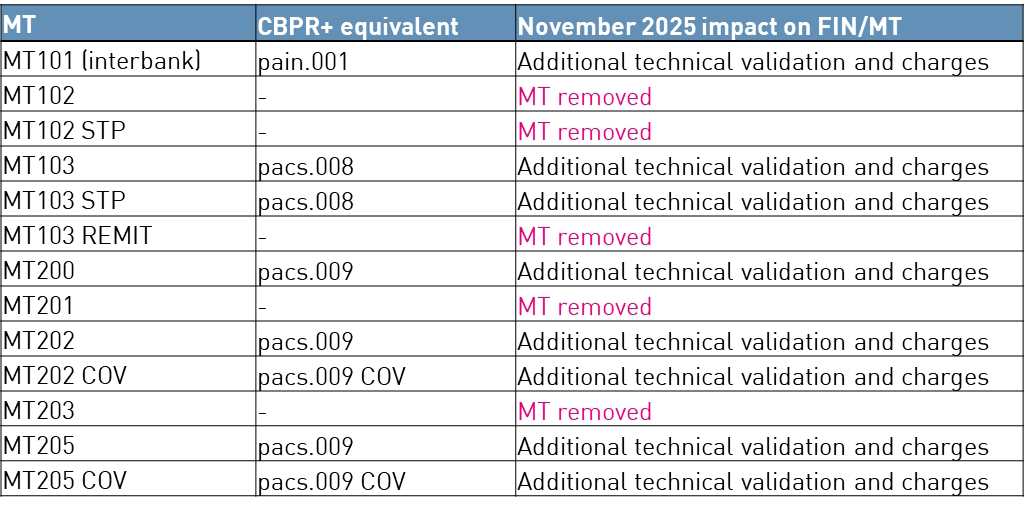

These include MT103 (customer payments) and MT202 (bank-to-bank payments). However, the conversion of MT103/MT202 to pacs.008 or pacs.009 after November 2025 is to be preceded by an additional technical validation, which is associated with increased fees. Details are to be published by the end of September this year at the latest.

Table from SWIFT publication: End of coexistence for instructions; Note: MT103 and MT202 REJT/RETN (pacs.002 and pacs.004 equivalent) also subject to end of coexistence impact

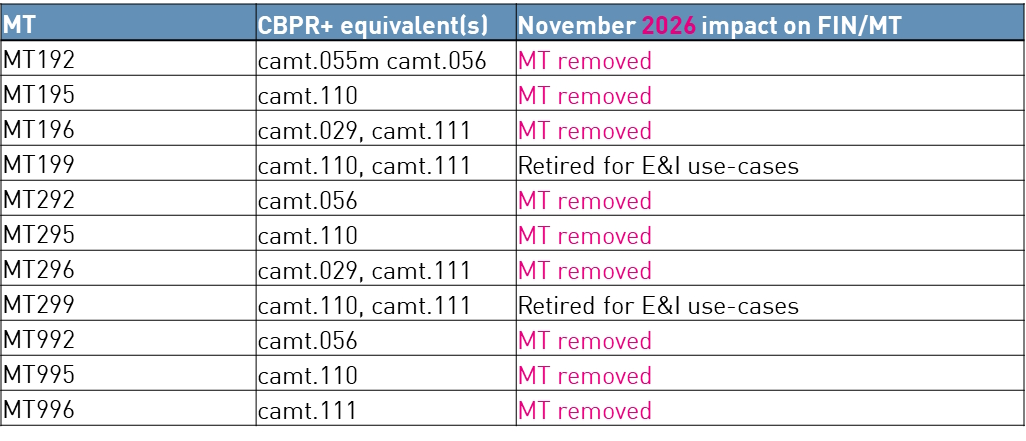

An additional change only becomes apparent when taking a closer look at the tabular appendices to the SWIFT update: Under the messages for “Exceptions & investigations” (including data records for the recall of payments or the rejection of such a recall), November 2026, instead of November 2025, has now beennoted as the end of MT/MX coexistence.

Table from SWIFT publication: Exceptions and investigations

An overview of all changes can be found here.

Summary

The end of the coexistence period of MT and MX messages, which had already been postponed for hybrid addresses, is no longer firmly scheduled with the latest publication.

On the surface, banks that are MX-capable by not later than November 2025, should have no problem with this. However, even well-prepared financial institutions will have to ensure receipt of the old MT formats until the switch-off – which will inevitably mean additional work and tie up resources.