The planned shortening of the settlement cycle to T+1 will about one of the most far-reaching changes in European securities settlement since the introduction of T+2 in 2014. The project requires decisive action from all institutions involved. T+1 stands for the settlement period. In future, securities transactions must be concluded and settled no later than one day after trading.

In August 2024, my colleagues Ulrike Uitz and Florian Sager wrote an overview article on the topic of T+1 in which they discussed the preparatory work for one of the key post-trading reforms in Europe – and formulated initial recommendations for banks. With the final report by the European Securities and Markets Authority (ESMA) for the European Parliament and the EU Council, it is now clear that the switch to T+1 is coming – across the board and probably from 11 October 2027.

Standardised T+1 launch in the EU, UK and Switzerland as a “big bang”

According to the plans presented by ESMA, the migration to T+1 will take place simultaneously for all asset classes, transaction types and market segments – analogous to the US approach. There are no plans for a different timetable for individual countries or product groups. The migration will affect all institutions that are involved in the securities settlement process in any way – not only commercial banks, but also asset managers, custodians, fund platforms and market service providers.

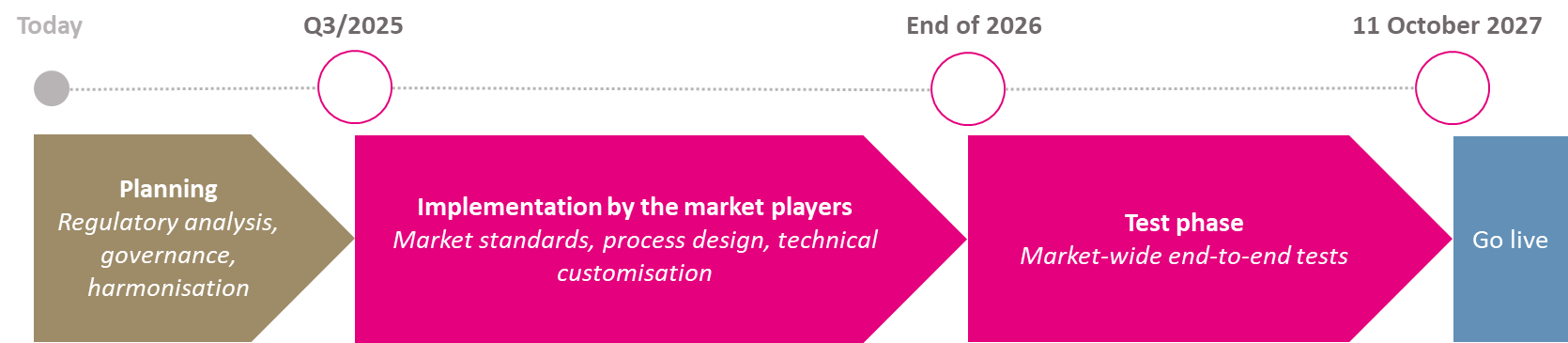

Roadmap proposed by ESMA for the operationalisation of T+1

Banks need a clear implementation plan now

Back in August 2024, we outlined how banks should react internally to T+1. These recommendations are now more relevant than ever thanks to the latest ESMA publications. Especially important:

- Impact analysis: Which products, locations, systems and counterparties are affected?

With regard to point 1), it should be emphasised that many settlement systems today are batch-oriented legacy systems. If they have not already done so, the institutions must check whether they can be converted to T+1 at all without significant changes.

- Process mapping & gap analysis: Where are there media breaks or manual activities?

- Automation & standardisation: focus on STP, ISO 20022, data quality

- Governance & communication: Set up project structure, involve stakeholders

These four points form the basis for an internal bank roadmap in order to be prepared for T+1 in good time. The longer banks wait, the greater the pressure will be, especially in view of upcoming tests and necessary adjustments to the infrastructure.

Standardisation with ISO 20022 also in the securities business

A key technical lever for the successful T+1 changeover lies in the area of messaging standards. ESMA is expressly in favour of the consistent introduction of the ISO 20022 message format in the securities sector. The standard enables automated processing without media discontinuity – a must in a shortened settlement cycle.

DPS has already successfully supported the migration to ISO 20022 in payment transactions for numerous banks and financial service providers – as well as the introduction of T2S and the T2S market migration. We also bring this professional and technical expertise to the world of securities – for a smooth implementation based on established methods, tools and standards.

Risks are shifting – processes must now be stabilised

In its report, ESMA identifies numerous operational challenges on the path to T+1: from FX handling and margin management to ETF settlement and corporate actions. Without end-to-end automation, the risk of settlement fails increases – with potential effects on liquidity, costs and reputation. The extent to which CSDR will be used in the future is currently being discussed.

T+0 already in sight as the next stage

Although T+0 is not yet specifically planned, ESMA already considers it to be the next stage of development. Real-time settlement of shares, corporate bonds and fund units is not possible on the basis of the existing settlement systems. Nevertheless, anyone investing in modern, standardised post-trading processes today is laying the foundations for future waves of changeover – and at the same time strengthening their own competitiveness in the capital market environment.

Conclusion

With the migration date provisionally set for 11 October 2027, it is clear that T+1 is not a regulatory option, but a binding requirement with a profound impact on operational business. Banks and securities institutions must start reviewing their settlement processes now – particularly with regard to messaging, data management and time-to-market. Those who cannot present a reliable T+1 roadmap by autumn 2025 at the latest risk delays in technical implementation, bottlenecks in the test phase – and competitive disadvantages in the post-trading business in the long term.

DPS follows developments closely and continuously. Our customers regularly benefit from the latest updates, analyses and classifications – practical and easy to understand here on our corporate blog and our LinkedIn presence.