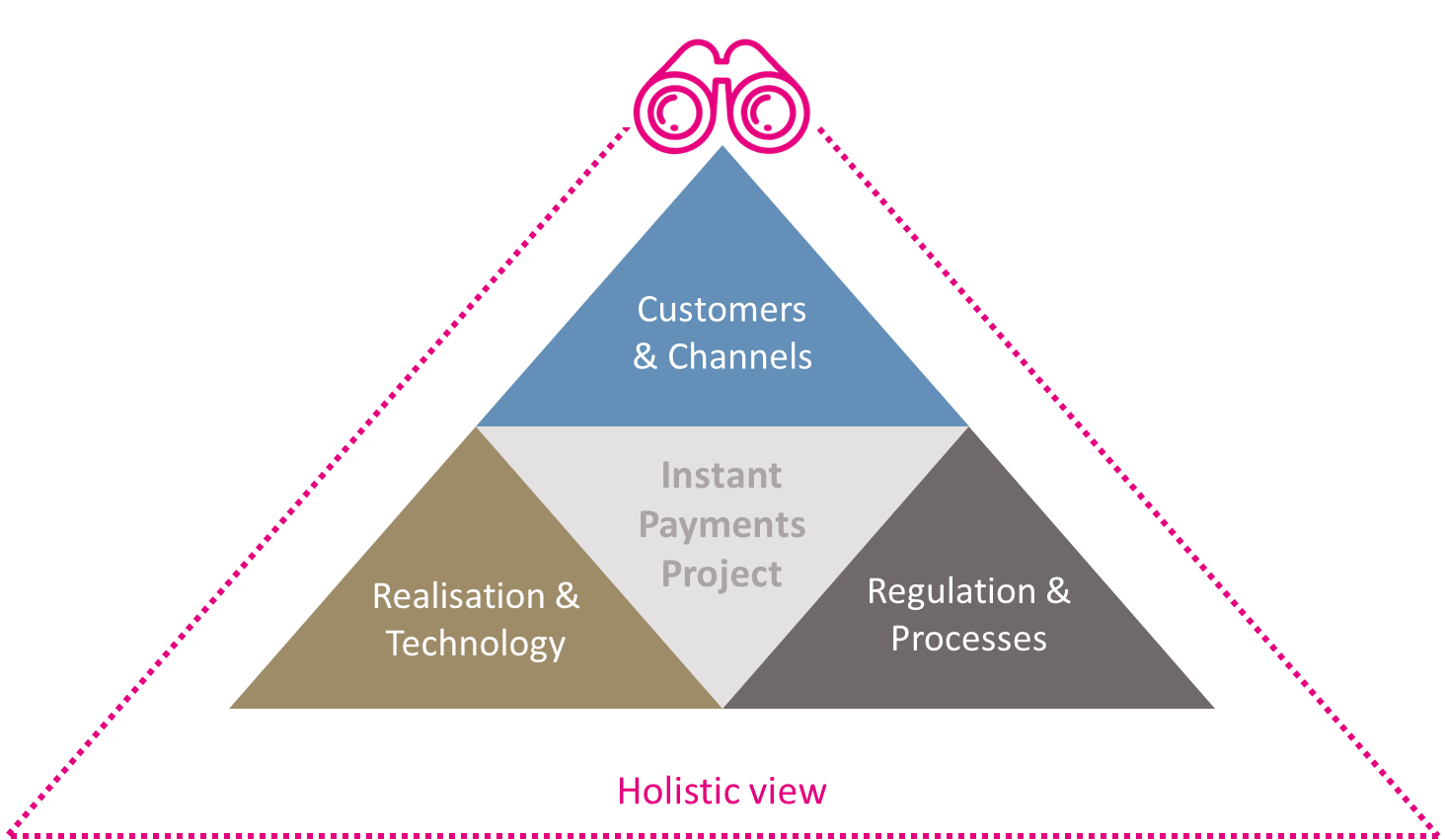

Holistic Consulting

We see instant payments as a change that has a significant impact on customer behaviour, operations and technology as well as the banks’ business models. Our approach looks at this triangle holistically and analyses the impact at each level. Here you will find all the information in a compact summary.

A focus on customer behaviour: We look at how customer behaviour in payment transactions is changing through instant payments. What expectations do different customer groups have? How does the introduction affect their preferences and usage habits?

Operational and technical implementation: We develop detailed implementation plans for banks that show what activities are required and when and how they are needed. From the adaptation of systems to the training of personnel, we provide support every step of the way to ensure the smooth integration of instant payments.

Impact on business models: We analyse the long-term impact of instant payments on banks’ business models. How do instant payments become the “new normal” and what strategic adjustments are needed to stay competitive?