Over the past 7 years, we have imagined what will happen when instant payments become mandatory and what added value they can offer a bank. We have discussed many use cases in the industry and set up a variety of scenarios. But now it’s here – the obligation. So the question is no longer: “What are the use cases?” but rather: “As a financial institution, how do we deal with it now? Can money still be made with payment transactions in the SEPA zone? Or is it just a matter of implementing the requirements of the regulation as cost-effectively as possible?”

The regulation of the European Parliament adopted in February stipulates that payment service providers will in future have to offer their customers real-time payments around the clock. The regulation was published in the Official Journal of the European Union on 19 March 2024. It came into force 20 days later. From then on, PSPs had 9 months to be passively reachable and 18 months for the active connection and IBAN name verification.

The necessary changes cover all relevant areas of SEPA payment transactions

Input channels

Institutions participating in SEPA payment transactions must provide instant payments through all channels that allow regular SEPA payments. In addition to online and mobile banking, these include self-service terminals, transfer forms, payment transactions in the call centre, by fax and in the branch. This raises not only technical but also procedural questions: How is it possible to ensure that paper-based transfer instructions are processed in accordance with the regulation? And does it make sense to keep all channels, including those such as fax, open and expand them accordingly?

Verification of Payee

One of the topics that has already been extensively discussed is the IBAN name check, also known as the verification of payee (VOP).

This means that the recipient bank must check whether the IBAN and name match before the payment is triggered and then send back a reply. If there is only a partial match, the name must also be given. Problems in this respect include a uniform and complete database, second names, legal forms, deviation from the company name and account holder, etc. If ineptly implemented, the VOP can lead to many unauthorised rejections of payments. In addition, this must also be implemented across all channels: at the counter, at the terminal, through online or mobile banking, by telephone and many more. In the PSD3 payment services directive, the IBAN/name check is even transferred to all SEPA transfers.

A public consultation is currently underway on the proposal for technical regulations. Comments could be submitted there until 19 May 2024. It will be exciting to see how the topic will be implemented.

Embargo, sanctions screening and money laundering

There are also major changes in fraud prevention. Real-time transfer providers must check against specific sanction lists on a daily basis. The KYC (know your customer) processes are therefore even more complex and must be adapted.

Bulk files/bulk processing

For bulk payment transactions, bulk payments need to be broken down into individual components and executed quickly and efficiently. This requires technical capacity to process many transactions in seconds.

The regulation has an impact on revenue and cost structures as well as liquidity management

Liquidity management

The impact of instant payments on liquidity management has already been discussed with the introduction of the SCT Inst pan-European instant payment scheme. In most banks, the euro liquidity planning focuses on end-of-day processing. The D+1 processing of regular SEPA transfers makes it possible to adjust the required liquidity on a daily basis to the accrued incoming and outgoing payments. This is not aimed at processing payments in real time.

In the past, the impact of instant payments on liquidity management was minimal due to the small volume structures. This is likely to change when instant payments are the “new normal”.

Revenue and cost structures

In future, an instant payment transfer may not cost more than a classic transfer. For a few institutions, it is therefore an option to allocate the investment for the implementation of instant payments through the price and service schedule for payment transactions, as this would mean making SEPA transfers generally subject to a fee – a measure that is unlikely to be accepted by the customer.

Instant payments open up opportunities for new business models

In recent years, the impact of instant payments on the payment services market has been minimal. Attempts to establish Hippos – instant payments at the POS – failed, amongst others due to the lack of cooperation of the banks.

The regulation and therefore the widespread distribution of instant payments sets these thoughts back in motion. SEPA Request-to-Pay provides a message type that can be used to reduce the user input of the payer to a simple acknowledgement or rejection. And once the PSD2 payment services directive is implemented, payment services have the opportunity to offer integrated services without the involvement of the bank managing the account. These building blocks open up some scope for payment services beyond established card schemes.

Comprehensive advice is crucial – from regulation to the development of new business models

There is no “one fits all” for the implementation of the regulation

Depending on the technical starting point and the business model, different strategies are effective. When implementing the regulation, an institution must make some basic decisions that significantly affect the workload, risks and costs. A few key questions are as follows:

• Expand existing SEPA transfer systems or purchase your own instant payments system?

• Outsource the development, purchase your own systems or outsource the processing of instant payments?

• Implement the regulation unilaterally or modernise payment transactions comprehensively?

The advantages and disadvantages depend to a large extent on the existing system landscape and the role of payment transactions in the institution’s business model.

We support you

In order to overcome the challenges described, it is necessary to have a neutral partner by your side, who manages the project and provides comprehensive, long-standing expertise. In some cases, it can make sense to upgrade old systems or to outsource payment transactions.

Our services in a nutshell:

• Analysis of the specific impact of the regulation on the institution and its business model

• Consulting on the development of an implementation strategy and the selection of suitable providers

• Preparation of professional and technical rough and detailed specifications

• Support for the implementation project in the relevant project roles (agile, classic or hybrid)

• Assumption of development and test tasks

Together with you, DPS analyses the infrastructure, sets up scenarios and a project plan that meets the deadlines. We advise in particular on the topic of Verification of Payee (VoP) and also offer a solution for this. All information on instant payments implementation with DPS can be found here.

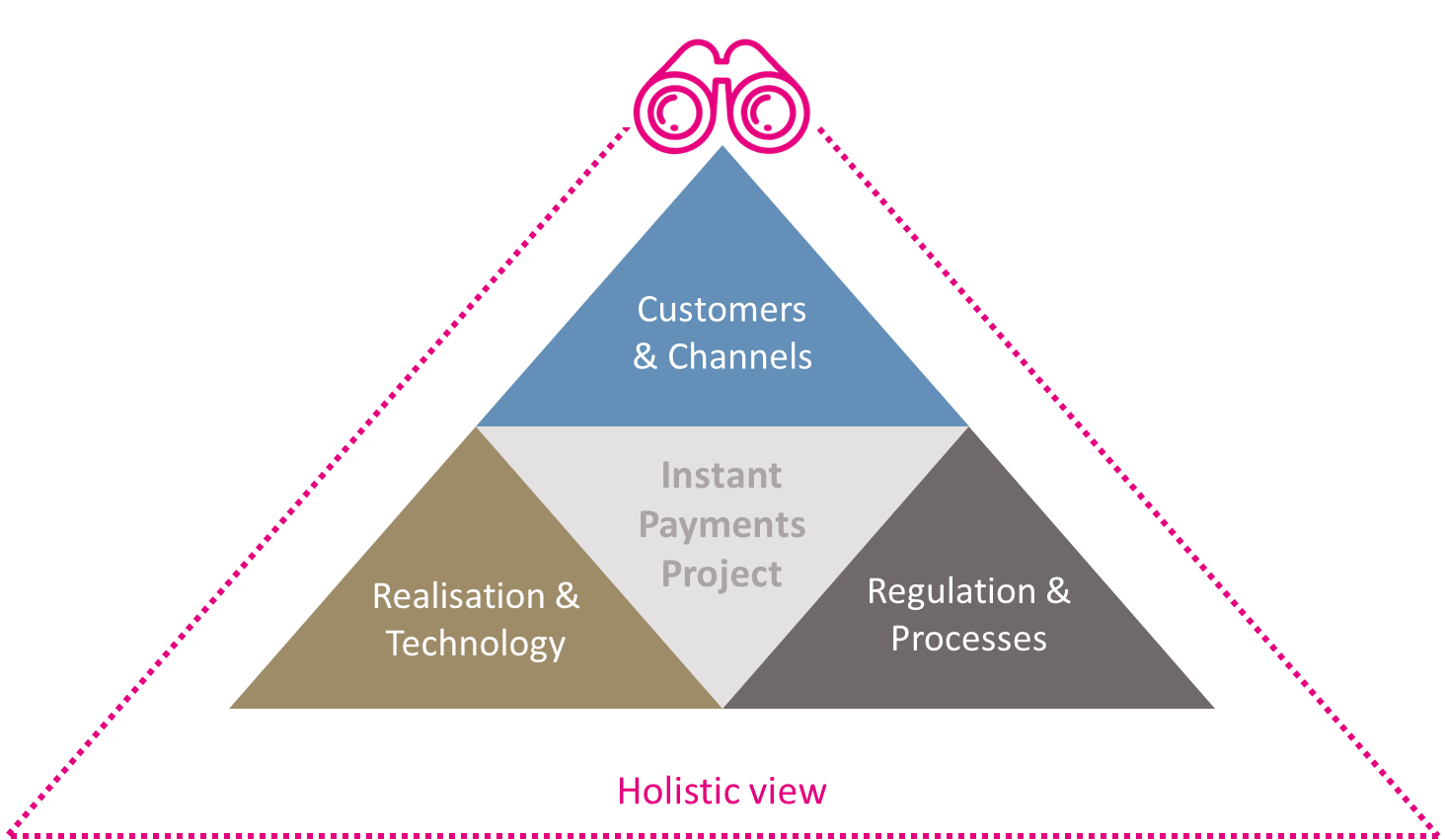

Thanks to our extensive know-how in areas such as payment transactions, core banking systems or multi-channel banking, we have a holistic perspective of the project and consider the commercial aspects in addition to the legal requirements.