The timetables for converting the payment traffic systems for foreign and large-value payments to the new de facto standard ISO 20022 were overturned at the end of October. In what amounts to a domino effect, the planned “big bang” in TARGET2 was first postponed from November 2022 to 20 March 2023. A week later, SWIFT followed suit with CBPR+. What are the reasons for this, and what do the participating banks have to pay attention to now? Here are the answers following careful analysis.

The problematic development in TARGET2 consolidation was foreseeable. Since the user tests began in December 2021, several problems have arisen that have worsened the test conditions; something the ECB recently acknowledged. Reference was made, for example, to the “instability of the test environments”, “incomplete and deficient delivery of the software” and problems with the “speed of assessing incidents and rectifying deficiencies”. Unsatisfactory testing conditions were cited by both “Level 2” central banks and direct users as an obstacle to their timely readiness (Source: ECB TARGET Services, 25.10.22). We have already described these problems in our latest article for “gi -Geldinstitute”.

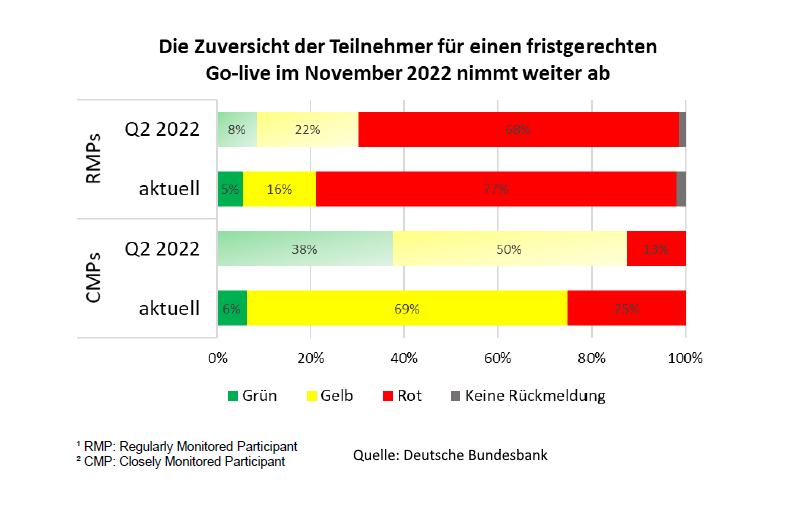

“Red light” for readiness to migrate

These problems are also reflected in the results of the Community Readiness Survey Q3/2022: Just under 900 of the approximately 1,150 Regularly Monitored Participants (RMPs) reported a “red light” in terms of readiness to migrate. And four of the 16 German Closely Monitored Participants (CMPs) have reported this as well. Compared to the survey in the second quarter, the number of red notifications increased significantly, according to the German Bundesbank.

Ultimately, it has to be stated that none of the participants can yet give the full “green light”. While many banks were able to successfully pass the Mandatory Test Cases, large case constellations are difficult to test if the central system is not ready for a review. Thus, there is as yet no guarantee that cross-border payment transactions between EU central banks and banks inside and outside the EU can be smoothly converted to ISO 20022.

Information for T2 participants

Currently, the ECB is following up with weekly releases for the test environment. The next Go/No-Go decision is scheduled five weeks before the new “Big Bang” date of 20 March 2023. Which is why the following three points are deemed to be urgent for participating banks to consider:

- It has to be clarified at which IT points changes have to be made to ensure that operations can continue in the “old” TARGET2 world from 21 November. Banks that have undergone an “overhaul” in their T2 application are, therefore, now under enormous time pressure.

- Despite the four months “gained”, the mandatory test cases should continue to be run through so that a high quality of the processes is ensured and guaranteed for the “big bang”.

- The test environment should be prepared for so-called “penny tests”, as they are already permitted by SWIFT. It can be assumed that the ECB will also make use of this test instrument.

SWIFT follows ECB

For many observers, it was obvious that SWIFT would have to follow suit after the ECB’s decision on TARGET2. The synchronous changeover originally planned for this month was intended to avoid costly transition scenarios and thus ensure interoperability between the systems. Falling behind this parallel migration would have led to barely solvable issues, as we already described in March 2020.

SWIFT refers to this in its justification for the CBPR+ postponement: An “overwhelming majority” of the community had spoken out in favour of a postponement. However, when taking a detailed look at the explanations, other interesting aspects stand out. This can be seen in the FAQ: The long-awaited go-live of the Transactions Manager Platform (TMP) is still envisaged for this November, but the first transactions are not expected to run on it until next May. This means one month of CBPR+ without TMP, which means banks see the risk of possible data truncation and data loss. There are currently no further explanations from SWIFT regarding this time difference. It can (and must) also be noted: Problems with the TMP are said to have caused a delay in the ISO20022 migration project before.

Finally, two important notes for the participating banks:

- The renewed postponement of the CBPR+ ISO 20022 migration ultimately means no gain in time, as the MT/MX coexistence phase starting on 20 March has been shortened by four months.

- Similar to TARGET2, it must be ensured on the IT side that participants can continue to operate in the “old world” for four more months.

Do you have questions about this topic or need the advice of our ISO20022 experts? Please feel free to contact us.