Germany’s leading provider of financial market data, WM Datenservice, has launched a new project that builds on the previous efforts of the EDDY_neu project. An extensive revision of the master data delivery system for securities is now in the works under the name Fontus. To complete the migration on time before the go-live in the 3rd quarter of 2026, banks must set up their Fontus projects now.

(Editor’s note 16 July 2025: For an update on the migration plan, which has since been postponed, please click here.)

Background: In 2019, WM Datenservice aimed to build a thoroughly modernized IT infrastructure with EDDy_neu (Enhanced Data Delivery), which included optimized data acquisition. Then, in 2022, the test phase of the project demonstrated that the processes and the data traffic between Datenservice, customers and IT service providers were not yet working smoothly. Customer feedback from the test phase also revealed that many market participants were not yet sufficiently prepared for the relaunch with their internal projects. The planned launch of the EDDy_neu interface on Easter 2023 was subsequently cancelled in order to reorganise the project planning and better integrate market participants.

New cooperation, progress and current status

A central element of the reorganisation is the strategic partnership with IBM. This cooperation partner has extensive experience in reorganising complex IT infrastructures, which should ensure that Fontus is not only up to date technologically, but also meets the highest standards in terms of reliability and performance.

Since the relaunch, Fontus has made considerable progress, especially with the integration of market participants (including banks and investment fund providers). A central committee, the Technical Sounding Board (TSB), meets regularly to steer development and ensure that customer needs remain a top priority. In the last meeting in July 2024, several important milestones were achieved which will decisively influence the further course of the project.

One essential focus is on the migration procedure. The two-stage process will involve careful preparation and the subsequent gradual migration of data. This process should ensure that the conversion to a new system runs smoothly and without major interruptions by the end of 2026.

Time is short: Set up Fontus projects now

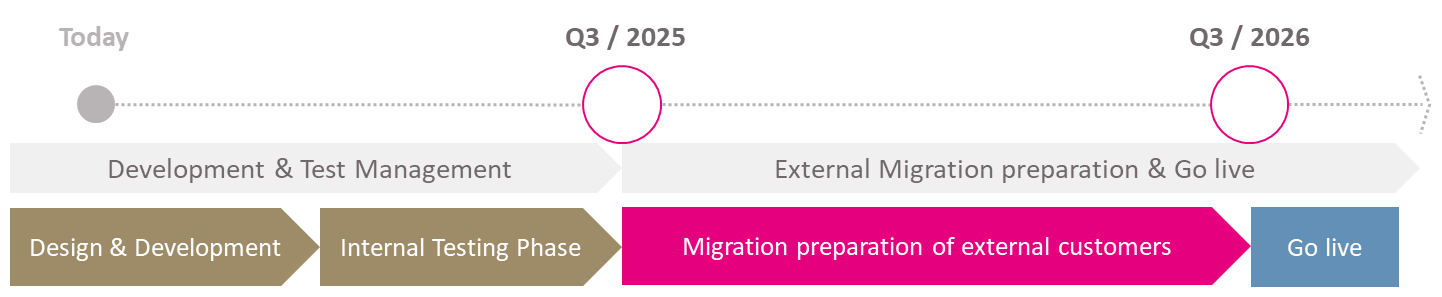

Keyword migration: In view of the experiences with EDDy_neu, it can be said that the banks must set up their Fontus projects now in order to fully exploit synergies of the new coordination process between WM and data providers and complete the migration on time before the planned go-live in Q3/2026. According to the current plan, the migration preparation of external WM customers should begin in Q3/2025.

Expected timeline for migration preparation according to WM Datenservice – Fontus Information I068 from 23/07/2024

To gain a deep understanding for their specific migration needs, a questionnaire was developed that covers all relevant subject areas. In particular, the requirements for the test data will be recorded in detail to ensure that the migration preparation receives optimum support this time around. Financial institutions can submit information about their individual migration to Fontus until 13 October 2024.

During the migration itself, the data transmission will take place in two steps: First, the main migration, followed by a delta migration to replicate any changes or updates in the productive system. This incremental approach allows the data migration to be completed successfully and without long downtimes.

Technical challenges

The complexity of the project requires a series of technical solutions to meet the numerous requirements. This includes the delivery of production-related test data, which is provided in the preparation phase and during the so-called user acceptance tests (UAT). These tests are essential to ensure that all processes work as planned and that the integrity of the data is guaranteed.

Another topic that has been discussed intensively is how to handle changes during the migration preparation. Errors that are identified should be corrected immediately and all affected customers informed accordingly.

Master data delivery in XML format

Banks and investment fund providers should pay particular attention to the fact that master data in Fontus will also be delivered in XML format. This is an opportunity to set a starting point for the standardisation of in-house data formats in the securities sector. Similarly to payment transactions, the XML-based standard ISO 20022 will also eventually be established as the new normal in securities processing.

Expert consultation on Fontus

Comprehensive project experience in the field of data migration in the financial sector combined with our extensive expertise – the DPS consultation service for market participants connected to Fontus is based on these two pillars. From an initial impact assessment and preparation to migration support, we are happy to assist you.